Based on recent data, the average American has 90k in debt, with millennials’ debt around 78k per person. That’s a lot of debt for a single person! This may be due to high education costs, mortgages, and insanely expensive medical fees in America.

Having debt is not fun, but it doesn’t mean we can’t take baby steps to improve our finances.

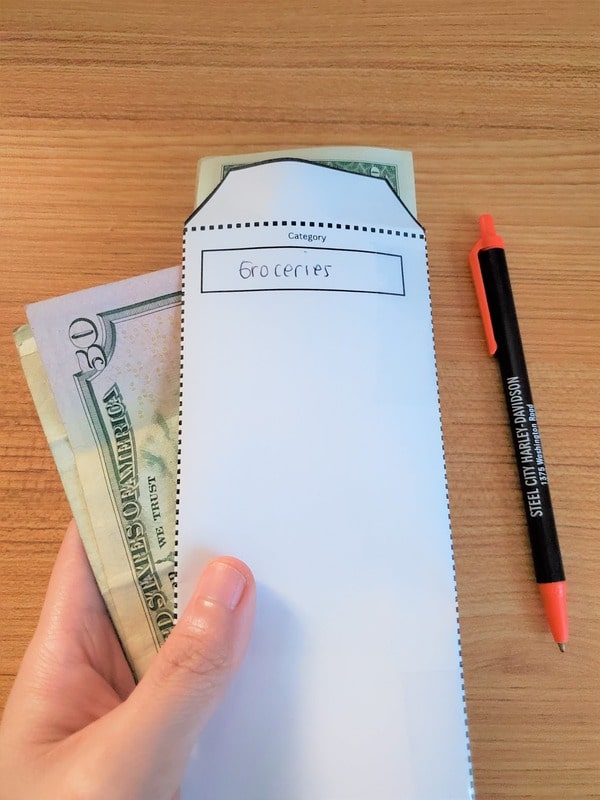

Money or cash envelope systems are one of the popular budgeting systems, which is great for those who want to be more disciplined with their spending.

If you are looking for printables to help you stick to your budget and improve finance with the money envelope system, this post is for you.

How do cash/money envelopes work?

The money envelope system is a budgeting method that allows you to physically spread out your monthly income toward different saving goals.

The concept is simple: Having specific categories, such as groceries, rent, restaurants, gas, student loans, etc., will determine specifically how much you will need to save each month and separate them accordingly.

For instance, if you have one category, let’s say restaurant. Maybe you decided to put $150 there. Then, in the middle of the month, you realize it is empty. Once the money is gone, then it’s gone. You would have to wait until the next budget to spend on restaurants. The good thing is this will help you stop overspending and control your finance better.

What is the benefit of using a cash envelope tracker?

It prevents you and (anyone in your family) from overspending

It can be tempting to go overboard during payday because you see a good chunk of money to spend when login into your bank account. You don’t know which one has gone for gas or groceries. You might forget that some rent due or other bills are coming soon.

With a cash envelope tracker in hand, this will easily be avoided because you’ll have a designated budget for each spending category. You can see physically how much money you have left in each budget. There will be fewer or maybe even no surprises at the end of the month.

Instead of swiping a credit or debit card, you’ll be forced to hand over cash in exchange for your purchases, making you think twice before making the purchase.

It makes you feel more controlled over your finances

Because you know where your money will go, your bills have already been taken care of, and how to plan for your emergencies, you’ll feel more at peace with your finances.

Every time you grab cash from one of your money stuffing, you’ll feel comfortable spending it because you know that’s the budgeted amount. When you go to restaurants with your friends, you will likely have fun and less worry because other bills are already covered.

Generally, it helps you become more relaxed knowing that your finances are in order, which can also contribute to your overall health and happiness.

It helps you set priorities.

Budgeting, in general, can help your set priority straight. When you sit down and have some money to split, you will wonder how to spread your money across these spending categories.

A few questions might pop up.

- How much money do I need to allocate for rent, medical expenses, car loans, etc.?

- Do I want to add more money to travel or maybe a restaurant?

- Or, maybe I want to be debt free or even financially independent someday, and I am ok cutting some expenses?

During this process, you will get a sense of your highest cost and what category expenses you spend it on. With this knowledge, you can be more deliberate with your spending and personal finance strategy.

Last but not least, budgeting with money envelopes can be fun

Add some colors to the envelope to make it more exciting and yours. You could add a motivational quote or why you were doing this to remind your long-term goal.

Maybe you can also add stickers to your money wallet if that’s what you’ll use. Budgeting doesn’t have to be boring, right? Plus, the sound of cash is relaxing 😆.

Do the cash envelopes system work? What are the pros and cons?

It absolutely works, but just like any other habit-breaking endeavor, it requires self-discipline. As long as you are willing to

You may feel tempted to grab money from your retirement when your shopping money is gone, but try to prevent yourself from doing so. When you feel the urge to shop, replace it with another activity, for instance, maybe calling your friends.

Pros

Some pros are that money envelopes help you visualize how much money is left in each bucket. That way, it forces you to be more mindful of your spending, thus helping curb overspending on impulse purchases. It is also pretty cheap and easy to set up.

Because you portion your money ahead of time, you may also find yourself building your savings and emergency fund quicker. Furthermore, when you allocate your money ahead of time, you are more likely to spend your money on what you truly enjoy and value.

The cash-based envelope system also helps avoid bank overdrafts and interest fees that can occur with frequent debit and credit card swiping.

Cons

Because this tool would require some cash to be stuffed in the envelope, it increases the risk of theft. So, make sure you secure it in a safe place.

Another con is that you’ll probably miss some interest and capital gains. Instead of having cash, you could have put the money in an online savings account and investment. But if you use the money within a short time anyway, you probably won’t lose much interest and gains.

Not only that, but you may also miss some rewards and the protection that credit card offers. For instance, if you made a purchase and something goes wrong with the purchase, you won’t be able to dispute it.

But using cash is still strongly recommended if you struggle with card spending. Research says that it is more painful to use cash than cards. Furthermore, you will also will more likely to value what you bought. More benefits of using cash:

- The physical action of handing over cash can make you stop and think about how much you are spending.

- You’ll be forced to watch your cash funds diminish as you spend the money in each cash envelope.

To optimize your personal finance journey, I’d also recommend cutting on unnecessary expenses and finding more ways to save money

How can the cash envelope system transform your finances?

With the cash envelope system, anyone can easily see how much they spend in each category based on the cash on hand.

Here are some steps on how to start:

1. Create a budget

The first step is you will need to create a budget. This is the key to being successful with the money envelope system.

If you have never created a budget before, it will take a couple of iterations to find the budget that works for you. Don’t worry about perfecting it; start somewhere, and you will adjust it over time. Or, you can estimate each category’s spending and modify it as needed.

Here are some steps to start creating a budget:

Calculate your net income

List your sources of monthly income. If you have a side hustle or freelance work, don’t forget to subtract any taxes and costs.

Calculate your expenses

The best place to start is by reviewing your bank and credit card statements or start saving your receipts for future transactions. If you don’t typically use a credit/debit card, collect all of your receipts for a month or two, and at the end of the month, sort them into gas, groceries, entertainment, and so on.

I recommend using personal capital to consolidate all accounts and check your spending category. The spending categorization is not perfect, but this is a good starting point to get a sense of your spending.

In addition, you can also use this tool to track your expenses and income. It is generally a good practice to track your expenses at least once a month.

Categorize your expenses and set a limit for them.

Here are some common expenses:

- Groceries

- Gas

- Rent

- Mortgage payments

- Insurance (health, auto, or home)

- Utilities (electricity, water, and gas)

- Internet/phone

- Restaurants

- Entertainment

- Vacations

- Clothes

- Hobbies

- Child-care

Once you set a limit for each bucket, label whether they are fixed or variable expenses; this is useful because when your money is tight, you can always drop your variable expenses. For instance, you learned that you spend $200 more than your net income. You can reevaluate your variable expenses and find ways to cut costs.

Fixed expenses are expenses you expect the same for the long term, for instance, rent and car payments. These are generally the bills you cannot avoid.

On the other hand, variable expenses will likely vary from one month to another, and they are flexible enough to exclude from your budget if needed. Examples of variable expenses are restaurants, groceries, Netflix, and gas.

Consider your short-term and financial goals.

Remember to create a realistic budget. Think about your short-term and long-term financial goal. Short-term goals typically take one to a few years to achieve. For example:

- Paying down student loans and credit card debt

- Building emergency fund

- Building FU money so you can walk away from your job if things go bad at work

Long-term financial goals could be:

- Saving for retirement

- Saving for your child’s education

- Paying off your mortgage

- Achieving financial independence

If you find that you have X amount of dollars to save after your necessities, you may want to consider the above things. Or, perhaps you also don’t want to be too rigid that it sacrifices your presence too much.

2. Print out the cash envelope systems

Now that you are done calculating the budget, you can download and print out the cash envelope systems below. Print as many as you need, but I’d suggest keeping it simple. Too many envelopes can be overwhelming and hard to manage.

You can start testing the system by printing one envelope, say groceries, and see how it works. The cash envelope system didn’t have to be for every spending category you have.

If you tend to overspend in a certain area, let’s say clothing, this can be a good starting point. Entertainment, clothing, and groceries are good candidates because people usually tend to overspend in those areas.

3. Fill your envelopes with cash

After setting your spending limits for each cycle, filling your cash envelopes would be easy. For instance, if you have a $200 budget for food, use $200 for foodstuffs; even better, use less than the budgeted amount.

If you have leftover money at the end of a cycle, you can roll it into the next one or put it in savings or emergency funds.

4. Review your budget regularly and adjust as needed

As you continue to use the envelope money system, you may need to adjust along the way. In fact, changing your budget along the way should be an expected part of the process. Don’t expect you’ll have a perfect budgeting system in the first month.

Maybe you learned that you have too many buckets and only need a few. Or, maybe some categories are overly stuffed while others are very slim. All of this is part of the process, and no single budget works for everyone. Ideally, you want to keep your spending caps for each category close to what you need each month.

When you closely watch yourself, you will likely be more conscious of your thoughts and spending habits.

What are common pitfalls?

When you spend your money, ensure you only look at the envelope balance, not the entire bank account or your net worth. If you look at the total money you have before you spend, let’s say you put your fixed spending in your checking account, and you might again think you have lots of money to spend.

Also, if you mess up, don’t beat yourself up! If you accidentally overspend, it is not the end of the world. learn from it and try to do better next time.

How often should I stuff my envelope?

You can fill your envelopes bi-weekly or once a month. American typically get paid bi-weekly, so you can do that if you are preferred. For instance, if you put $800 into your rent budget, you can break the payment into two paychecks. So you would put in $400 each time you get paid. This is a good option so you won’t feel like the payment is taking up all your paycheck.

Do I pay these expenses in cash? How do you use the cash envelope system for online purchases?

You can either:

- When the payment due date comes, you deposit the money in the ATM and pay online. Similarly, if you want online shopping, you can set a rule to go to the bank and deposit the cash physically. Using this method will increase the friction of any variable purchase and makes you less likely to make an impulsive decision.

- You can keep your fixed expenses in your checking account, meaning you won’t have to pay anything using cash. But set a rule that you can’t use your debit card for any variable expenses.

- You still purchase online but track your spending on your budgeting systems such as YNAB or a simple excel sheet. The cash envelope system doesn’t have to be used in every spending category. It’s best used in the category where you tend to overspend.

How does money envelope differ from traditional or digital budgeting systems like YNAB/Every dollar app?

YNAB and Every dollar app are based on a zero budgeting system, meaning every single dollar from your income must be assigned. It is similar to cash envelope systems, except you manage your money virtually. With this app, you won’t have to carry your cash. Similarly, the YNAB app shows how much money you have left for the rest of the week but digitally.

But you will have to log your spending with the app regularly. It might be less of a learning curve if you log your spending routinely. But the good thing, though, is that you can have a big picture of your spending trends. One thing to note is that some of these apps are not free.

But if you are starting and want to get better at your spending habit, I’d suggest starting with cash envelope systems because using physical money is generally more painful. Once you improve your self-discipline, you can try a digital budgeting system.

What if I spend more than expected?

If you spend more than expected, don’t beat yourself up! You can take some money from the other bucket to compensate for that and try to do better next time.

Analyze when, how, and why you spend more than expected. Is it because you are bored, then you go to your amazon account? Increase the friction of amazon access. For instance, delete the app or log out. Is is when you watch certain influencer on youtube? That’s usually my case. So I unsubscribed.

Maybe also turn off the shopping notification and unsubscribe from the deals notifications.

A few more techniques:

- Remember your long-term goal. Is it to afford a vacation to the EU? Is it to build savings so you can buy time to be a full-time artist? Is it to build FU money so you can walk away anytime things go bad at work?

- Find out how many hours you have to work to afford that. Use net hourly rate. For instance, if your hourly rate is $20 an hour, to buy $100 clothing, you have to work five hours to afford that. Is the cloth worth five hours of work? Is it better to use the $100 to pay off your debt?

- Write a specific plan. For instance, if you tend to go overboard in the grocery store, only bring the budgeted cash with you so you can’t spend more. Or, if your husband tends to overspend, don’t bring him.

In conclusion

The cash envelope system could be a good solution if you are inclined to spend more than expected. It helps you to stop and think about your spending before purchasing. Focus on on one or two areas where you tend to overspend, and start there.

Vi, a software engineer with a keen interest in personal finance, had planned to retire once she reached her lean FI/RE (Financial Independence/Retire Early) goal. However, after achieving the goal, she took few months of a mini-retirement filled with travel and adventure and decided to continue her career.

For the past five years, Vi has been using Personal Capital (Empower), a free financial tool. Her favorite features include the dashboard for net worth, allocation, and planning, which help track her FI/RE goal and keep those investment fees in check.