According to Bankrate.com, only 23 percent of Americans have enough six months of emergency funds if they lose their job. Many are unwilling to live within their means and drastically cut their expenses.

I was in a similar situation when I was in graduate school. I know how stressful it can be when something unexpected comes. Not only I had my school debt and everyday household expenses, but I had to worry if my old 2000 Honda civic car would break down again.

As a result, I was really on a budget – trying to cut my expenses to the bone. Looking back, I was thankful to my past self for prioritizing saving money.

Here are a few things you can do to drastically cut expenses to build up your emergency fund quickly and put more cash in your pocket.

I know it is very tempting to ignore the stress and watch Netflix instead – but you got this! 💪

Related posts:

Analyze your spending

The first thing you want to do is to find your largest expenses. Check out your credit card and bank statement spending analyzer. For instance, if you ate out too much, you probably want to set a budget around it.

There is two types of budgeting methods – top-down and bottom-up approach. Learn more here.

Surprisingly, I spent a lot on subscriptions and online classes last year. So, I’ve set a target that I will buy a maximum of 3 subscriptions this year.

Cut your phone bills

This is one of the first things that my family and I did when cutting costs. You will need two things to do this: an unlocked cell phone and a new sim card.

If you don’t have an unlocked cell phone plan, it is still worth getting an unlocked cell phone (or get your current phone unlocked if it is cheaper). Why? Because the amount of money you save will accumulate over time.

For instance, I switched from T-Mobile to a cheaper phone plan (Tello). With T-Mobile, I paid $90 (before taxes) for both my mom and my plan – after switching – the plan cost us $30 (before taxes). My mom and I signed up for a $10 and $20 plan, which comes with unlimited calls/text and a limited internet plan (check out the Tello site for the latest offer).

By doing this, we drastically cut our expenses by $720. For five years, it is ~$3600 (which you can save for travel, an emergency fund, or an investment fund). This is extra money in your pocket!

If you have more family members, the saving is even more.

If Tello is unavailable in your area, google “best-prepaid cell phone in [your_area].” Take an hour or two to research this well. You’ll be glad to do this in the future.

A few things to consider are:

- Network coverage

- Whether it is unlimited text/calls (I prefer it to be unlimited text/calls so I don’t have to keep track of my call usage)

- The amount of internet data (I currently have 4 GB since I have internet access at home)

- Most importantly, the compatibility of your phone. Before purchasing a new phone, you want to make sure their service can work on your new phone. On Tello site, you can enter the phone IMEI number and check if it is compatible.

- Customer service. I love it when email CS support is available as I don’t have to wait on the phone.

The main reason that I am not a big fan of postpaid phone plans is there is a surprise cost or extra fees in the bill. The plan costs $90 – however, after taxes, fees, etc. – it costs almost $100! 🤦

One extra step is transferring your existing number to the provider. Depending on your current provider process, I found it was quite stressful to do this with T-Mobile, but that even made me more glad to switch from it.

Beware of promotion rates – the charge usually increases after the promotion is over. Check their normal rate to calculate your saving cost. A family sharing plan may seem cheaper initially, but still calculate the individual plan, add them up and compare the cost.

Find a cheaper phone plan such as Tello ($10 bonus if you sign up here).

Move to a cheaper place

Years ago, I lived in a bedroom with separate utilities (water, gas, electric, and trash). The bedroom costs around $700 a month, but with utilities, it is almost $900!

As soon as my lease was over, I found a cheaper studio with a better commute that cost around $600 with utilities included. That has roughly saved me $3600 a year!

If you have an expensive place to rent (even worse, with a long commute), I recommend finding a cheaper place immediately.

A few more tips:

- Find a roommate that you can trust and get along with. I’d be super careful when finding a roommate, especially online.

- Move back to your parent’s home. If you get along with your parents well, staying with your parents will hugely save you money. This is an excellent option if you are in debt – it will be much quicker to pay off your debt.

Negotiate your cable bills or get rid of it

TV cable is one of the most expensive bills in the US. This is one of your best tickets to save money.

A few questions you want to ask yourself are:

- How much do you use your cable? Do you really enjoy it?

- Can you replace it with streaming services like Netflix, Amazon Prime, Sling TV, or Hulu?

If you are willing to get rid of your cable – with a hypothetical cost of $80 a month – you will save $960 a year. This money can be used for an emergency fund or rent for the next month.

If you still want to use your cable – which is totally OK! (I am not going to tell you to cut services that you love) – then you can try to negotiate the bill. Here is an example script for lowering Comcast’s bill.

Quick tip: You can also use the chat service at first. I am not great at thinking at my feet 😳 so I prefer chat. Try this script and see if the agent is willing to help.

Sample script:

Hi – I’d like to discuss my option with you. I’ve been a good customer for X years and I no longer able to afford my monthly payment option due to [for instance, the increasing cable bill]. I’d like to discuss my option with your help.

If you live with a friend or spouse who never had an account before, consider signing up under a new account and take advantage of the new customer promotion. I did to my mom’s cable bill because her rate is just insanely high.

My mom’s original bill was $120 a month just for the internet. Thankfully, I got it down to $30 a month for a year by using my name as the account holder. At least for a year – she has saved $1080, which is money she can add to her retirement.

Pack your lunch and set a budget for eating out

It is ok to eat out if you enjoy it and as long as it is under your budget. Are you wondering how much to budget for food? Check out this helpful article.

If you love eating out, I will not tell you to cut it completely. You can still be frugal and still enjoy life.

However, eating out every day will seriously cost you money. Imagine you spend $10 a day for lunch; that’s roughly $220 a month / $2,640 a year that you could have saved in your pocket.

A few tips:

- Pack your lunch the night before to save time in the morning. When I was still working at the office, I had to force myself to pack whatever in the night before, and I actually never regretted it the next day. Even the day when I only managed to pack one banana and two hard-boiled eggs 🍌🥚.

- Make too much dinner so you can eat the leftover for lunch tomorrow.

- Use your lunchtime to work on your side hustle, prepare for a certification or go to the gym. This adds more reason to pack your lunch.

- Visit your mom so she’ll pack you some food (No – just kidding, I visit my mom because I miss her. But I am not going to lie though, that food is the best part).

Maybe you can still get delivery or eat at a restaurant twice a month? Or you can budget it to $100 a month but cut the other costs that don’t matter to you?

You can also be creative to still enjoy eating out on a budget – for instance:

- Find Groupon and local deals online

- Pick up the food yourself, so you don’t have to tip

- Pick lunch over dinner since dinner is usually more expensive

- Review the menu before going out so you can pick an affordable, yet delicious menu (I do this because I want to see pictures 😄)

- Order water instead of soda to save some cost

- Share the meal and split the bills with your partner if you find the portion is usually big

I prefer eating at home because:

- I enjoy cooking and trying out new recipes.

- It’s a fun activity to do with Josh, my fiancee.

- I love home cook meals.

- It is cheaper and healthier.

- I don’t have to pay additional taxes (just for fun, this is an estimate of how much taxes you’ll pay overtime)

- No waiting in the line

Cutting costs on groceries

Here are a few things you can do to cut costs on groceries:

- Make fewer shopping trips.

- Make a meal plan, or at least check out your fridge before grocery shopping.

- Go to the grocery store with a list and stick to it.

- Don’t worry too much about the brand name. I personally grocery shop at Aldi and local Asian markets. Giant eagle occasionally (it is expensive, though) just because I have some gift cards.

- Pick frozen veggies since it last longer. Research shows that frozen veggies and fruits can preserve nutrient value and that the nutritional content of fresh and frozen produce is similar.

- Get a good water filtration system instead of buying bottled water.

- Do a week clean pantry challenge.

- Don’t shop with the overspenders.

- Don’t go shopping when you are hungry.

- Eat less meat.

- Buy whole instead of buying pre-packaged vegetables.

- If you have a little more time, you can also plan your meal around coupons/deals.

- If you are a student, ask if they have a student discount. At least in my area, the local Asian markets offer students 5% discounts.

Cut unused subscription

The next item to check is your subscription. For each subscription – ask yourself these questions:

- Do you use it?

- Do you really like it?

- Do you find multiple similar subscriptions?

- Can you find a cheaper alternative?

If you love your gym membership and have established a good routine – try to negotiate the price. If you don’t use it – maybe cancel it and work out at home.

I had a subscription that I rarely used, such as Amazon Kindle, LinkedIn Premium, and iPhone apps. Those services can easily cost me $45 a month or $540 a year.

Review your bank/credit card statement and look for recurring charges you forgot about – they could be:

- Pandora, SiriusXM, SoundCloud, Spotify, Amazon Music

- Magazine, Newspaper, Wall Street Journal

- Amazon Prime

- Resume builder services, Linked Premium

- Online courses (Coursera, Skillshare)

- Netflix, Hulu, HBO Now, SlingTV

Quick tip: Approach apps like Trim/Truebill with caution to lower your bills.

Waive Bank and Credit Card Fees

Check your bank or credit card statement and look for any bank/credit card fees. I use Personal Capital to find any hidden fees.

For instance, I found this monthly fee from one of my retirement funds. I did not realize I was being charged $14.5 per month! That’s $120 a year. If you have a similar situation, what you can do is open a retirement account with Vanguard because they charge a much lower fee.

If you find bank or credit card fees, give them a call.

Sample script:

“Hi – I’ve been a customer for X years, and I found I was being charged for a draft fee. I want to get its fee waived. “

If they say no. You shall insist and say:

“Look, this is a rare event, and I’ve been a valuable customer to your company. I’d like to get it waived”

If you still can’t resolve your issue, ask them to transfer you to the supervisor and repeat the same complaints. Nine times out of 10, you will be able to get these pesky fees waived.

Have fun for free

There are plenty of ways to have fun without spending much money. Follow are some examples:

- Visit a local library.

- Visit an animal rescue/pet adoption center.

- Go for a hike or a walk with a friend.

- Listen to an audiobook. I combine this activity when I am driving or taking a walk. I can kill two birds with one stone!

Try a FREE trial of Audible here. You’ll get one free audiobook and cancel it anytime if you don’t like the service.

- Watch YouTube videos to learn something new – such as playing musical instruments, learning a new recipe, or maybe a DIY project that you always want to start.

- Check out local festivals.

- Find interesting volunteer opportunities. I once volunteered as a room monitor for a conference for free with registration, lodging, and food.

- Enjoy your stay-cation with friends and maybe throw a potluck dinner.

- Plan your next travel and find good deals for hotel and airfare.

- Visit pick your farms.

- Meet new people and make new friends.

- If you are an avid movie watcher, you can also check out discount theaters in your area. For instance, currently, AMC theatres offer a $5 ticket every Tuesday in my city.

Related post:

Ask yourself these questions before making a purchase

The best way to save money is not to spend it. If you have an impulse buying habit (like I do) – ask yourself these questions before making a purchase:

- Do I really need it?

- Can you wait for the purchase for a few days? If it is on amazon, add it to the wishlist or jot it down on paper. 8 out of 10, I found myself losing interest in the item. If the item is survived, I’ll go ahead and start researching and finding the best deal.

- Do you already own a similar item?

- How many hours do you have to work for this purchase? Is it worth it?

- Do I purchase it to impress my friends?

- Will you use it a lot?

- Can you borrow it instead?

Write a plan – for instance, if I have the urge to spend money, I will:

- Add that to the wishlist, or my note

- Do something else: watch Netflix, text a friend or call my mom.

Repeat until you find something that works for you to override the impulse spending habit. If you really want to cure your impulse habit, try a no-spend challenge.

More questions to ask yourself (bookmark it so you can access the page quicker)

Get a high-interest online saving account with no maintenance fees

If you have some savings just sitting in a low-interest bank account, find online savings with a higher interest rate and park your money there.

For instance, I have Discover online saving account. It offers 1.9% APY – pretty good compared to other banks.

You can also check out Ally Bank, at the time of writing, offering 2.00% APY. I heard positive reviews about this bank, particularly its robust customer service.

Let’s say you have $10,000 in a local bank account with 0.1% APY; you will earn only $10 for the whole year as opposed to $200 with Ally Bank. That’s a big difference!

Use cashback websites and apps

You can get cash back almost on anything these days with cashback websites and apps. If there is an upcoming purchase you need to make, this is a perfect time to get some cash in your pocket.

The following are helpful steps when looking for an item:

- Research what specific item you want to buy.

- Shop around to find a good deal.

- Compare prices on different online retailers such as amazon.com, walmart.com, ebay.com, and target.com.

- For household items and cleaning supplies, check out Dollar Tree, Dollar General or Family Dollar. If you install the Dollar General app, you’ll be able to track all the coupons for the items you buy.

- For books, my favorite online store is Abebooks.com.

- Compare different cashback apps such as Ebates, Wikibuy, and Ibotta for cashback as well. If you take advantage of your cashback credit card, you will get double cash back!

- You can also combine it with your credit card cashback. Woohoo- talk about double cashback! For instance – I use Capital One Quicksilver with 1.5% cashback.

- Look for additional coupons online:

- Check RetailMetNot

- Look for your employee, student, or senior discount. Check out MyUnidays and Shop.ID.

- Simply google “coupon [store name].”

Quick tip: use cashback apps like Ebates and Wikibuy to make extra money.

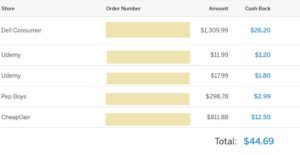

Some of my cashback from Ebates.

Be frugal on things that don’t matter to you.

Cut spending on things that don’t matter much to you. For me, I buy generic items for things like cleaning supplies, medicine, and stationery items. Sometimes a brand item may offer more quality, but sometimes it just means we pay more for the advertising fees.

I also don’t mind staying in a small apartment if that means I can be close to early retirement and pursue an art career.

If you love eating out, maybe budget your spending on the restaurants you truly enjoy rather than eating out at a casual place.

If you love branded clothing items, maybe pick a few high-quality, well-fitting pieces you truly love. Or, maybe it just means you can buy a few more in a thrift shop in the nice neighborhoods.

Whatever frugal living means to you – you get to decide on what’s important to you, and that’s empowering!

I hope you enjoy this post and find it helpful (if you find it helpful, please share this post 🙏)

Related posts:

Vi, a software engineer with a keen interest in personal finance, had planned to retire once she reached her lean FI/RE (Financial Independence/Retire Early) goal. However, after achieving the goal, she took few months of a mini-retirement filled with travel and adventure and decided to continue her career.

For the past five years, Vi has been using Personal Capital (Empower), a free financial tool. Her favorite features include the dashboard for net worth, allocation, and planning, which help track her FI/RE goal and keep those investment fees in check.