In this article, I’ll walk through setting up automatic investing with Fidelity on their website and mobile app. As of November/October 2023, Fidelity updated their UI and they added a feature to automate recurring investments for ETFs! I also love the new look because it’s a lot more intuitive than before.

Essentially with automated reinvesting, you decide how much, how often, and when to invest regularly, whether it’s weekly, bi-weekly, or monthly. If things change, it’s simple to adjust or cancel your recurring investment. You can also move money from your bank. It’s a smart long-term plan, and it’s called dollar cost averaging, a fancy term for it.

Dollar-cost averaging is a simple strategy where you invest a fixed amount of money at regular intervals, regardless of the investment’s current price. This helps smooth out the impact of market fluctuations over time. We buy more shares when prices are low and fewer when prices are high, reducing the overall average cost of your investment.

One time, after rolling over my IRA, I completely forgot to invest it. I kept waiting for the market to hit a low, and it ended up just sitting there for four months! I could have earned dividends or seen some growth, and speed up my financial independence journey. It would have been better if I had set up auto-investment.

More reasons to auto-invest

- Less emotional stress. Automated investing keeps your emotions out of the equation, so you don’t get swayed by market ups and downs.

- Buy low. It can be scary to buy when the market drops significantly. Automated investing helps you buy more when prices are low, taking advantage of market dips.

- Your money is always invested. Regular contributions mean your money is always in the game, working for you over time. You won’t miss out on the compound growth and the dividend over time.

- Forget market timing. You don’t have to worry about guessing the right time to invest; You decide once and then continue your life. Most of us have many things to care for, and deciding what and when to buy is already done. You have one less thing to worry about.

- Easy setup for everyone. Setting up automated investing is straightforward and suitable for anyone.

- Consistency in a busy life. It’s perfect for busy folks and my grandma who doesn’t even know how to turn on a computer —consistent investing without constant monitoring, or watching the news.

- Reduce impulse spending. It’s tempting to spend money when it’s just sitting in your bank account. However, transferring the money before you get the chance to spend it reduces the likelihood of impulsive spending. Automatically investing money not only reduces impulsive urges but also encourages healthy financial habits.

How to set up automated investing in fidelity?

1. After logging in to your account, go to https://digital.fidelity.com/ftgw/digital/recurring-activity/. If it doesn’t work, try https://www.fidelity.com/cash-management/automatic-investments.

You should land on the recurring activity page (look at step # 2). If, for some reason, you can’t land on the page, check on this step, instead.

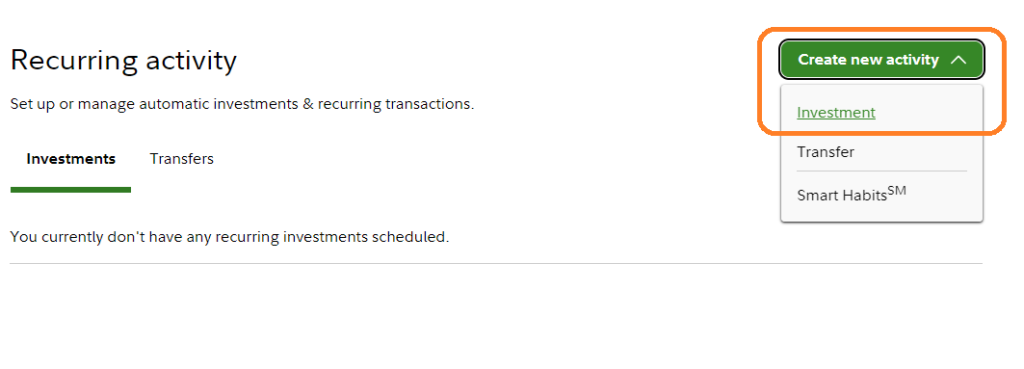

2. Click new activity, then click investment.

3. A new window should pop up.

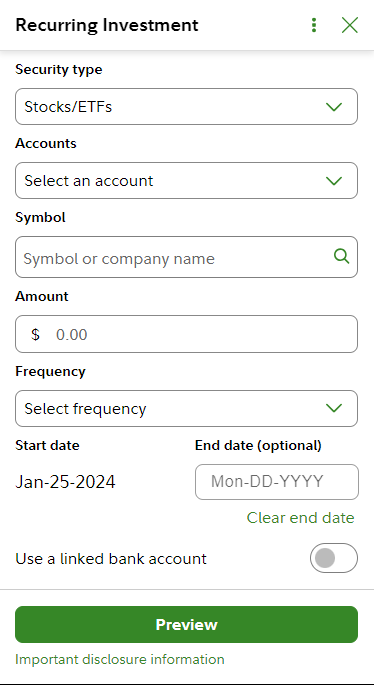

4. Fill out the information:

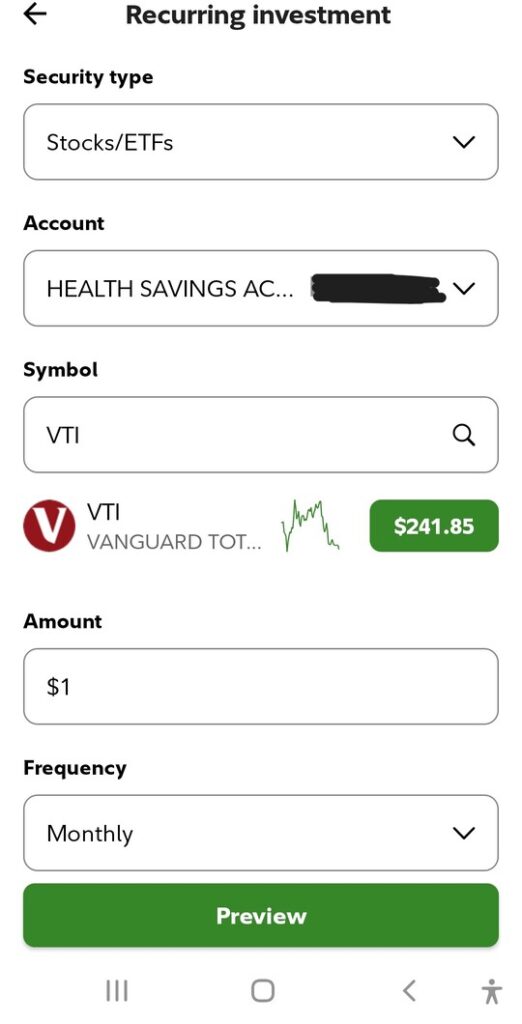

- Choose the security type – There are three options: Stocks/ETFs, Mutual funds, and Fidelity basket portfolio.

- Choose the accounts. This is the receiving account.

- Choose the symbol of mutual funds/ETFs/Fidelity basket portfolio.

- Choose the amount. According to fidelity, You can create a recurring investment plan to transfer any amount between $1 and $100,000 for stocks, ETFs, and baskets. For mutual funds, the range is between $10 and $100,000. Keep in mind that various funds might have specific minimum investment requirements.

- Choose the frequency and end date. If you don’t choose the end date, it’ll keep transferring the funds as long as you have enough money in the source funds.

- Toggle “Use a linked bank account” if you want the source fund in your linked bank account. If you don’t have one, you’d need to set it up first.

Note:

Automatic investing usually involves two steps: money is taken from one account (source), and then used to purchase another account (receiver). Sometimes, the purchase goes through even if there isn’t enough money in the first account, leading to a negative balance in the second account. So ensure that you have enough balance in the source fund to avoid any overdraft fees.

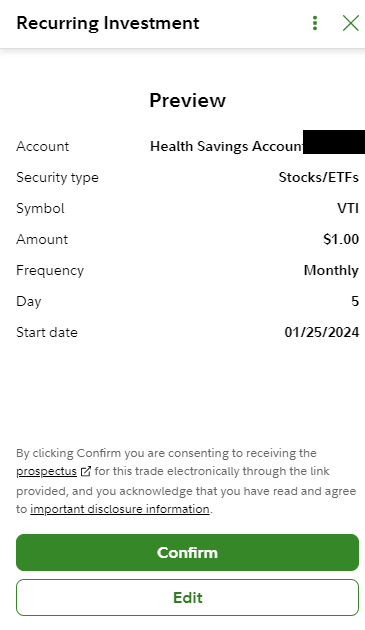

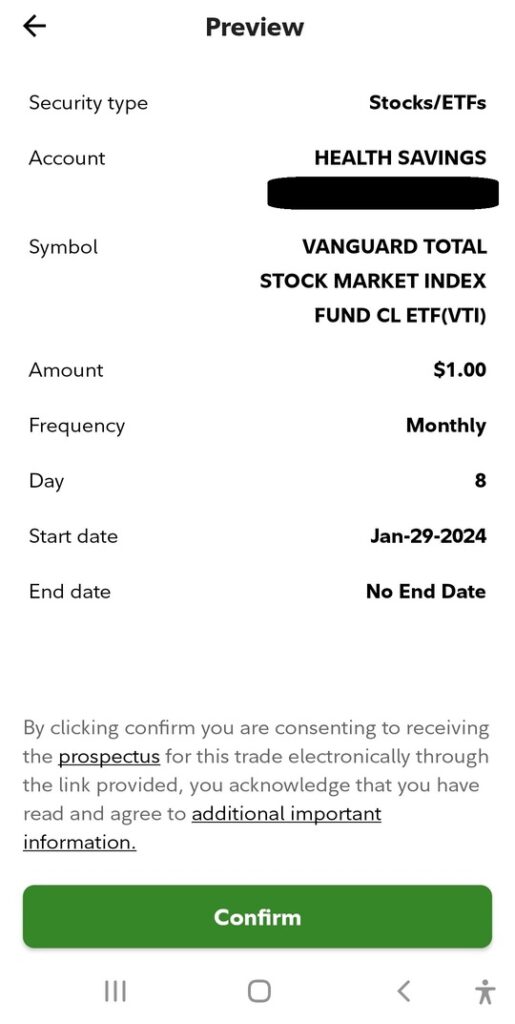

5. You’ll see a confirmation. Review the information and click confirm. Once it’s confirmed, congrats! 🎉 You just automated your finances. 👏

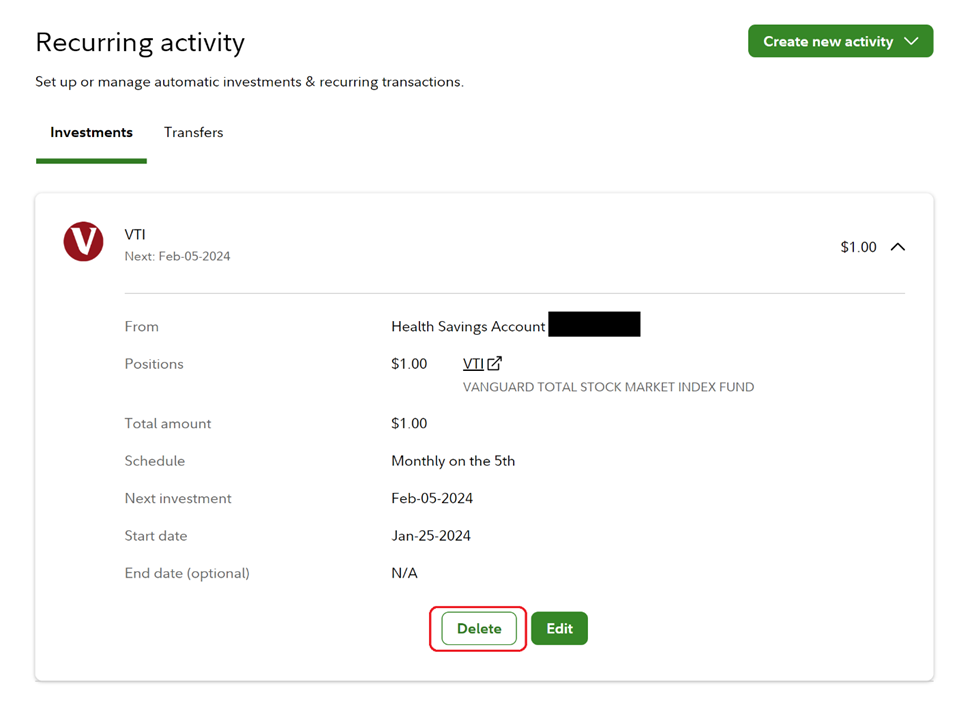

How to cancel automated investing on Fidelity?

Simply go to https://digital.fidelity.com/ftgw/digital/recurring-activity/, expand the activity, and delete the recurring activity you want to delete. Easy peasy!

How do I set up automatic investments using the Fidelity mobile app?

It’s a similar step. Below are the steps.

I’ve included screenshots to make it easier.

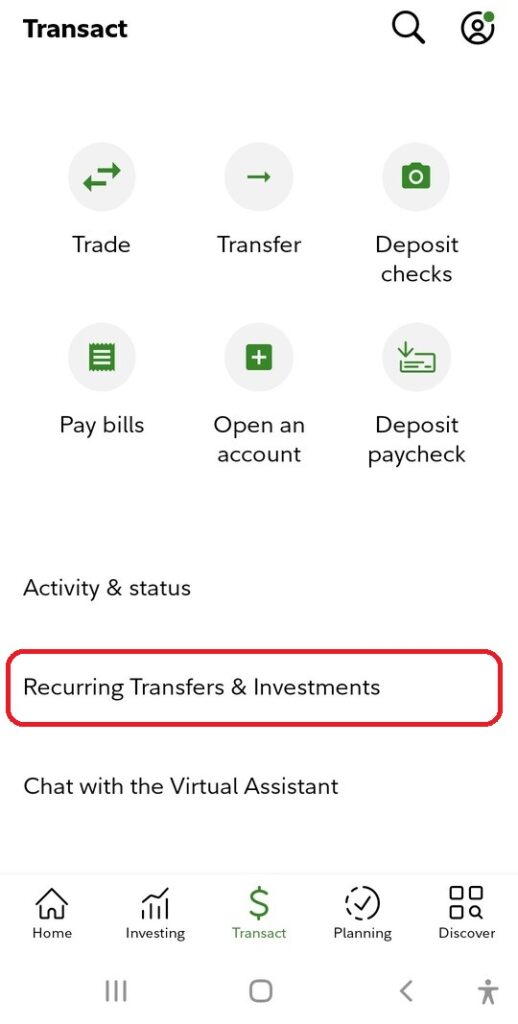

1. Login to the Fidelity app. Go to the Transact tab. Choose Recurring Transfer & Investment.

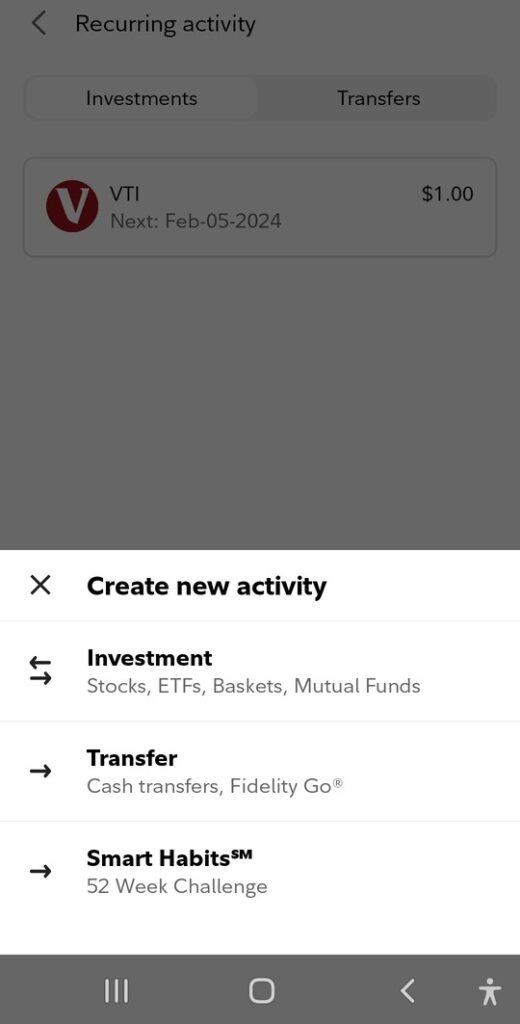

2. Once you are in the Recurring Activity page, choose Create.

3. Choose Investment.

3. Fill out the information and follow these steps. Choose Preview.

4. Choose Confirm.

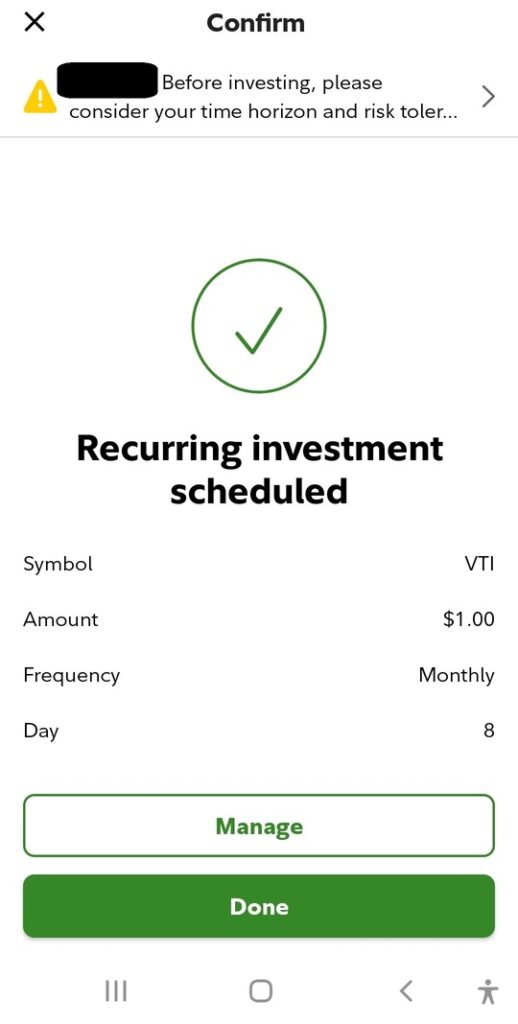

5. You’ll see a confirmation like this. And you are done! 🙌

How do I get to the automated investing page on Fidelity?

If, for some reason, you cannot access the page using the links, do the below steps:

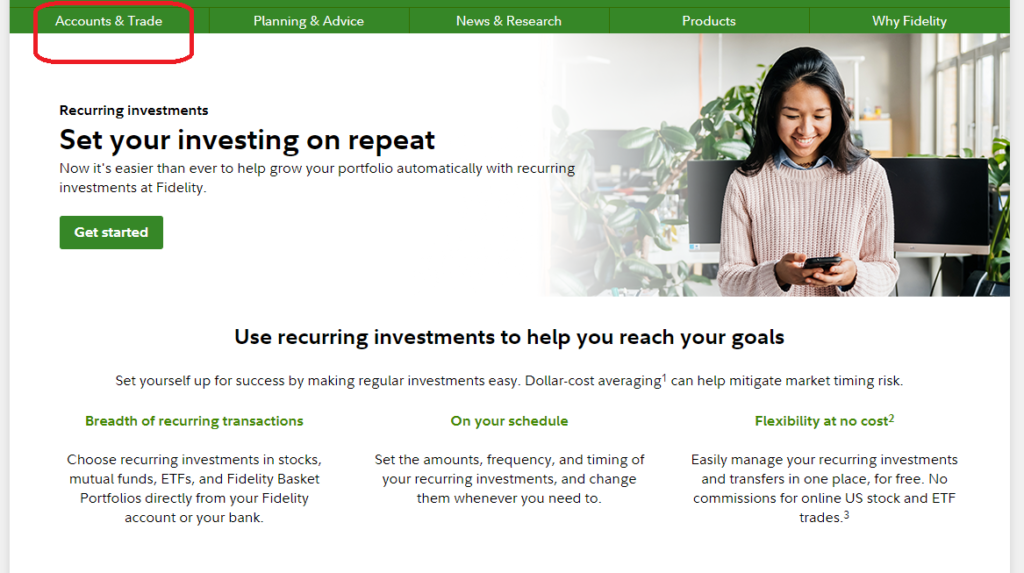

1. Go to automated investing and click Account & Trade.

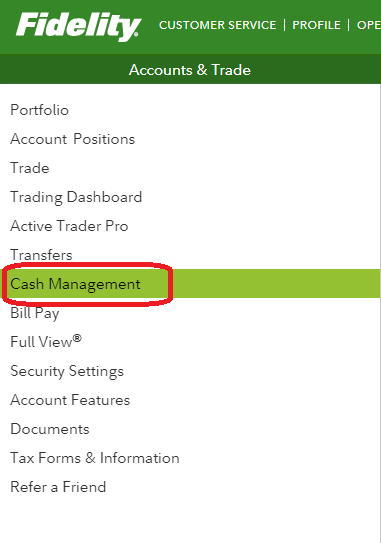

2. Click Cash Management.

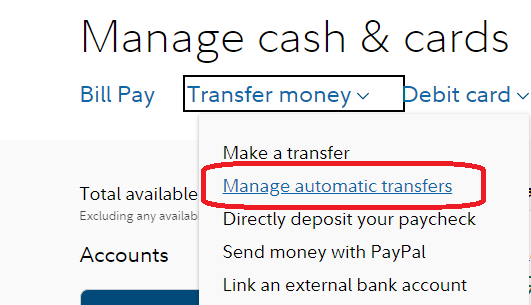

3. Once you are on the cash management page, click Manage Automatic Transfers.

4. You should land on the recurring activity page.

Common FAQ:

What’s the minimum amount to do the auto investment?

You can create a recurring investment plan to transfer any amount between $1 and $100,000 for stocks, ETFs, and baskets. For mutual funds, the range is between $10 and $100,000. Keep in mind that various funds might have specific minimum investment requirements.

For which types of accounts can I schedule automatic recurring investments?

- Regular accounts like brokerage or cash management

- Retirement accounts like traditional, rollover, and Roth IRAs

- Health Savings Accounts.

Does Fidelity have automatic transfers?

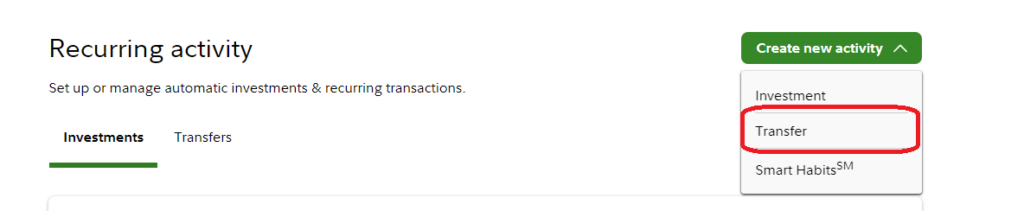

Yes. The setup is on the recurring activity page as well. Go to the recurring activity page and choose transfer, instead.

Does Fidelity have auto reinvest?

I think it’s referring to the same feature as auto investment.

Disclaimer

- This isn’t financial or professional advice. Please consult a tax or financial advisor for professional assistance.

- Screenshots captured in 2024 from Fidelity.com. They can be subject to change.

References

- https://www.fidelity.com/learning-center/personal-finance/automate-savings

- https://www.fidelity.com/trading/recurring-investments

Vi, a software engineer with a keen interest in personal finance, had planned to retire once she reached her lean FI/RE (Financial Independence/Retire Early) goal. However, after achieving the goal, she took few months of a mini-retirement filled with travel and adventure and decided to continue her career.

For the past five years, Vi has been using Personal Capital (Empower), a free financial tool. Her favorite features include the dashboard for net worth, allocation, and planning, which help track her FI/RE goal and keep those investment fees in check.